Macaulay Duration Calculator

Macaulay Duration Calculator

This Frederick Macaulay calculator is used to measure of the bonds sensitivity to the changes in interest rates.

Results...

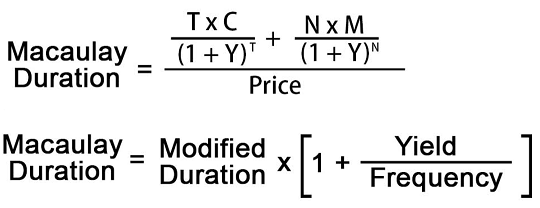

Formula for Macaulay Duration Calculation :

The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. This calculator uses the below formula to calculate the macaulay duration.

Where,

T - Total Time Period

C - Coupon Payment

Y - Yield

N - Total Number of Periods

M - Maturity

Price - Face Value or Present Value of All the Cash Flows

Recommended Pages ►

Recommended Pages ►

How Much Future value is Worth Today

Gas Vehicle Savings Calculator

Mymathtables.com

If you like Macaulay Duration Calculator, please consider adding a link to this tool by copy/paste the following code: